SIMRP Program

What is the S.I.M.R.P. Program?

Also Known As SIMERP Program: Self Insured Medical Expense Reimbursement Plan

Also Known As WIMPER: Wellness Integrated Medical Expense Reimbursement

The SIMRP Program is a participatory preventive care management program designed to help employees improve their physical and mental health. This innovative cost savings strategy is made possible by a set of tax codes that are part of the Affordable Care Act (ACA). The SIMRP Program can save employers a substantial amount of costs by reducing payroll taxes and lowering worker's compensation insurance premiums. There are also many indirect cost savings that can greatly benefit your organization.

Watch This Video To Learn More About the SIMRP Program

SIMRP Program Direct & Indirect Cost-Saving

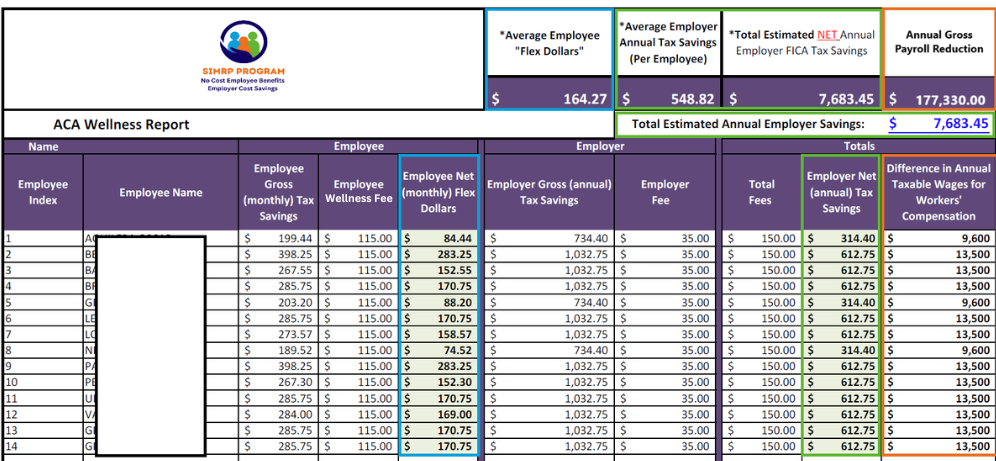

1) Save $500-$600 in employer payroll taxes per eligible employee.

2) Reduce worker's comp costs approximately 10%-40% by reducing gross payroll.

3) Some worker's comp insurance companies offer discounts for employee wellness programs.

4) Employees miss work less with access to 24/7 telemedicine doctor/counselor visits.

5) Wellness benefits help employees become healthier and increase employee productivity at work.

6) Healthier employees are less likely to develop chronic illnesses and that can reduce workers comp claims.

7) No net cost insurance and wellness benefits are very valuable to employees and can reduce employee turnover costs.

SIMRP Program Tax Codes

Example Of How The SIMRP Program Works

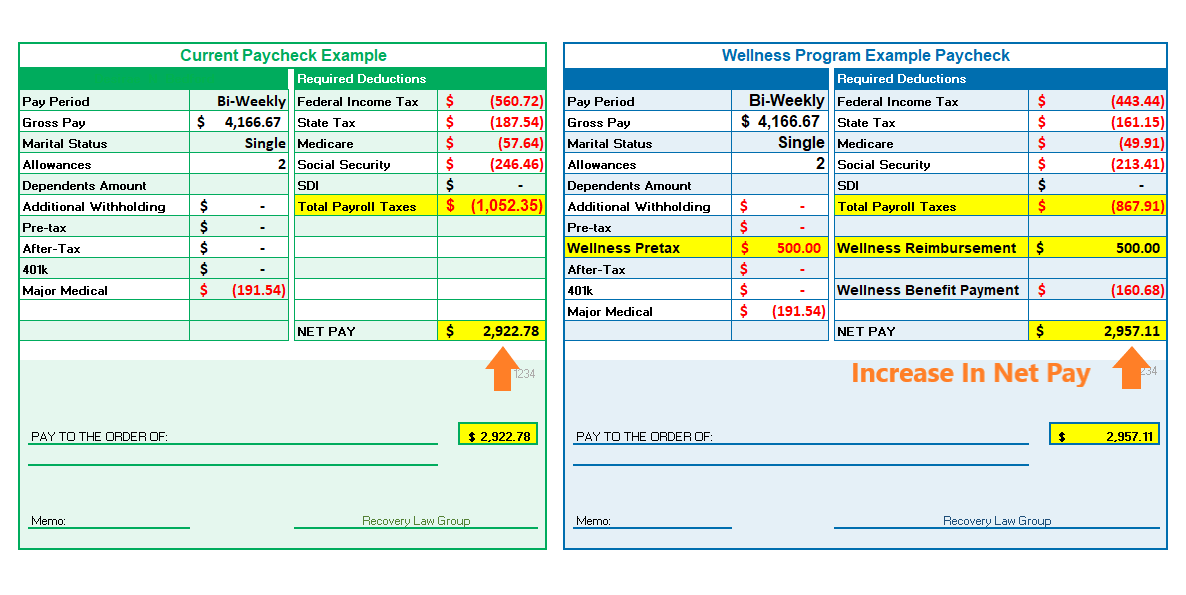

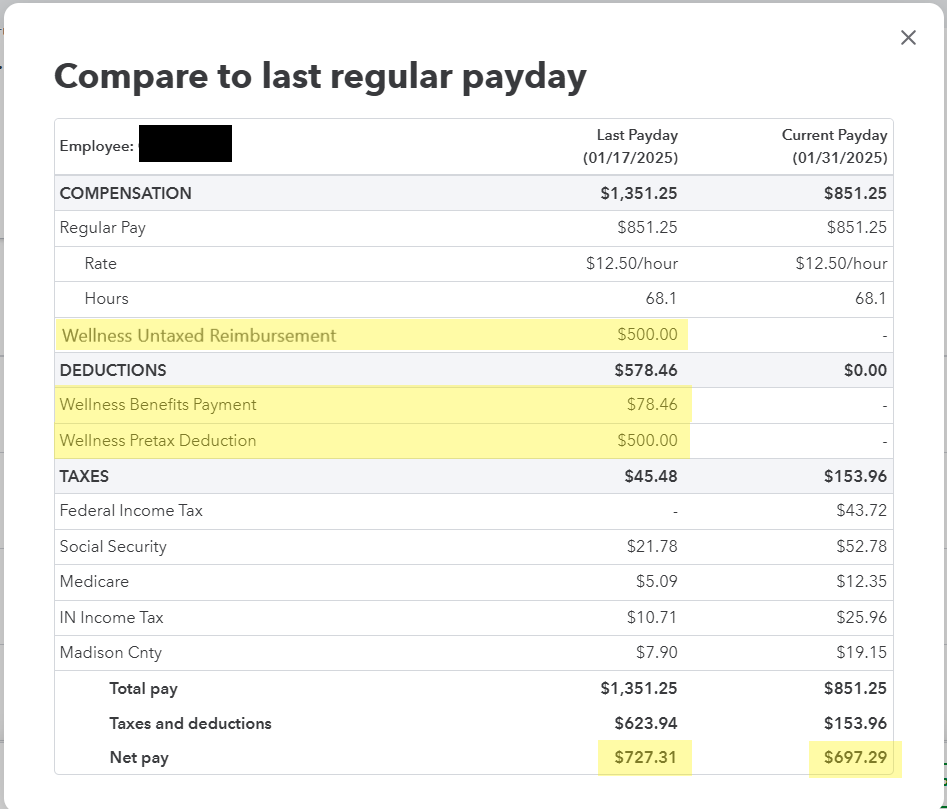

We use a pretax deduction and an untaxed reimbursement to lower the amount of taxes that they employee pays. We use that tax savings created by the program to pay for the cost of the wellness benefits and insurance benefits. There is also some left over tax savings that will increase the employees net pay.

14 Employee SIMRP Program Client Savings

Gross Payroll Reduction Example

The SIMRP Program reduces gross payroll for your qualified employees. Your worker's compensation insurance is calculated from your gross payroll. By reducing your gross payroll, you can save approximately 10%-40% on your workers comp insurance.

Normal Paycheck Without SIMRP

SIMRP Program Enrolled Employee

Who Can Use The SIMRP Program?

We work with large and small organizations located anywhere in the United States. Your organization can have as few as three full-time W2 employees or employers with thousands of employees. The SIMRP Program is compatible with any type of employer in the United States.

Businesses

Non-Profit Organizations

Government Agencies

No Cost Employee Benefits